Higher education has long been touted as the “great equalizer” for racial disparities in American society. Yet, the Supreme Court acted in opposition of this ideal with a rejection of President Biden's proposal to forgive up to $20,000 in student loan debt. Over time, the rising cost of higher education has steadily outpaced the financial means of low-wage workers to participate in these opportunities, currently leaving 43.6 million borrowers with student debt. Student loan debt negatively impacts workers’ economic mobility, the labor market, and racial wealth inequality. The absence of debt relief policy leaves the most vulnerable workers burdened by the many consequences of student debt.

Student loan debt has a negative impact on short-term labor market outcomes

Student loans burden many young workers with debt at a time when their lifetime earnings are at their lowest—early in their careers—and they have the least capacity to pay them off. Student debt is likely to elevate interest rates on other debts, which consequently raises the cost of consumption for borrowers. This financial constraint can drive young workers to modify their labor market preferences, making decisions that may acutely impact their careers in the long term.

Studies consistently show that student debt can sway decisions about pursuing further education. Several analyses have shown that students burdened with high levels of debt often postpone or opt out of enrolling in graduate or professional school: 20 percent of graduates with more than $20,000 in student loans report that their debt discouraged them from pursuing an advanced degree.

This effect can also extend to early career decisions. Graduates with debt are more likely to take substantially higher-paying positions and are less likely to choose lower-paying public interest roles. This influence on job choice skews a valuable portion of the labor force away from roles that are critical to our society.

Student loan discharge positively affects borrowers’ labor market outcomes. After discharge, borrowers experience heightened geographical mobility, job changes, and a subsequent income rise of approximately $3,000 over three years. This underscores how student loan debt constrains borrowers’ capacity to improve their labor market outcomes, highlighting the potential of debt relief to catalyze economic mobility.

Student loan debt is a significant barrier to economic mobility

Student loan debt is associated with lower levels of wealth building and limited upward mobility. Young households without student debt exhibit substantially higher net worth than those with debt. This imbalance is even greater for some demographic groups: Black and Latinx households with outstanding debt experience significant disparities in net worth compared to white households at similar income levels.

A substantial number of workers with relatively low student loan balances grapple with repayment challenges due to low-income work. As of 2019, 2.5 million young households bear a student debt-to-income ratio surpassing 0.5, with an average ratio of 1.03 for those in the bottom 50 percent of earners. Debt holders with annual income less than $33,769 had average student loan debt of $32,518 in 2022. Given these realities, it is not surprising that student loan holders are more prone to financial distress. Households with student loan debt have a higher likelihood of facing financial hardship, including late payments, credit denial, and foreclosure, especially if they did not complete a degree. Income growth for these families is minimal, while degree completers experience an increase of nearly $11,000 over two years.

Student loans, while crucial for social mobility among the younger generation, carry a lasting economic burden that distinguishes them from other debt types. This impact is attributed to its ineligibility for bankruptcy discharge, making it particularly enduring and impactful on credit and financial health. Loan forgiveness is found to alleviate some of this financial burden: student loan discharge leads to an 11 percent reduction in indebtedness and a 24 percent decrease in delinquent accounts for borrowers, with credit card and mortgage balances significantly reduced.

Intergenerational wealth gaps for Black and Latinx workers result in racially disparate debt burdens from student loans

In recent decades, there has been a growing influx of first-generation and low-income college students—often Black and Latinx students—who lack the resources and generational wealth needed to support their education expenses or repay their debts. The challenge of financing education may contribute to higher college dropout rates for students of color, resulting in elevated levels of financial distress for borrowers. Moreover, Black graduates experience a lower pay premium than their white counterparts upon completing their degrees.

The risks associated with student loan debt are greatest for those who do not complete their degree, which leaves borrowers strapped with student debt without the pay increase associated with a higher education credential. These borrowers are more likely to default on their loans and over time face demands for more education to secure the same jobs. As of 2019, Black individuals over the age of 25 are more likely to fall into this category of some college with no degree (39.4 percent) than their white and Latinx counterparts (37.9 percent and 36.2 percent, respectively), which further exacerbates the racial student debt gap for Black borrowers.

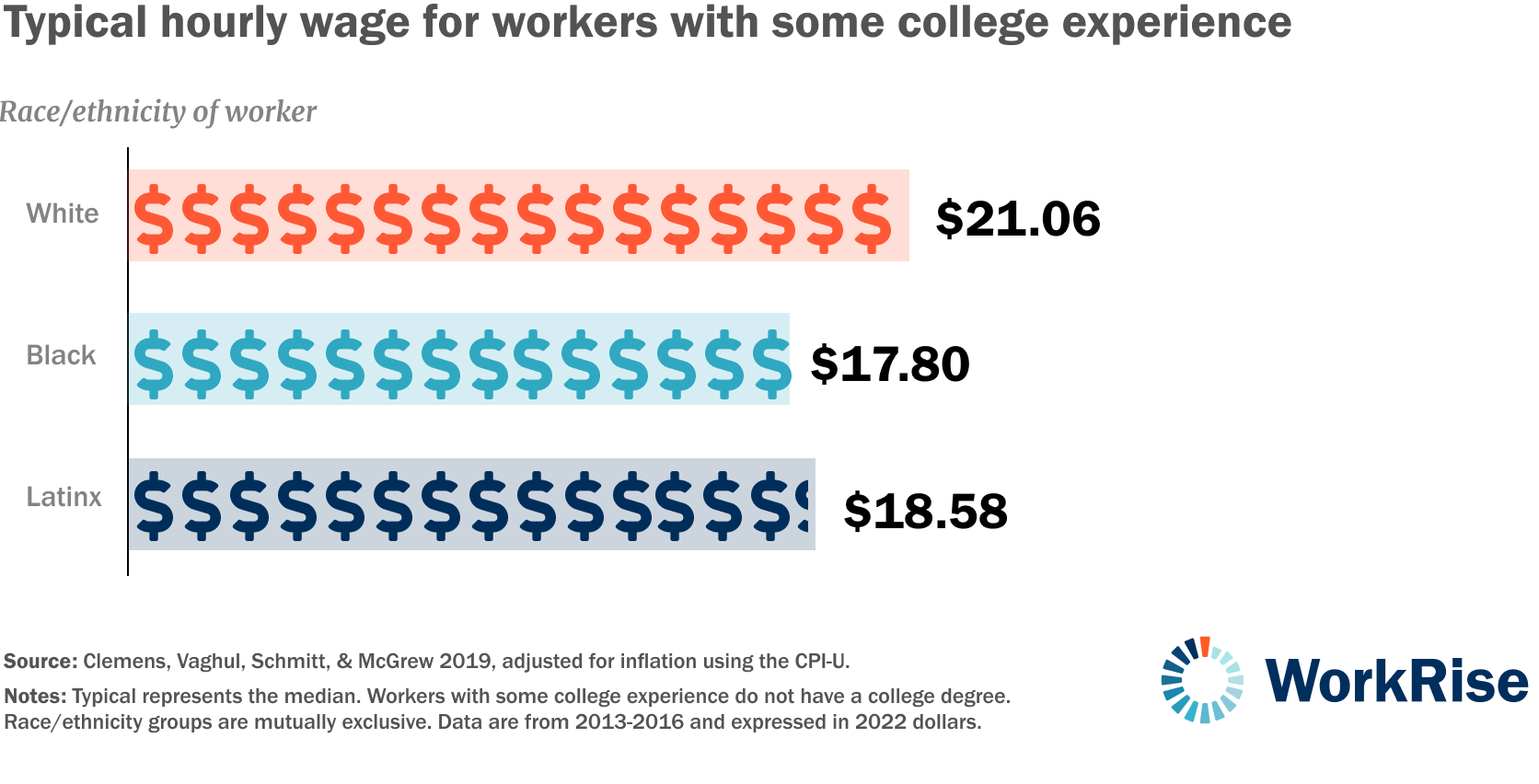

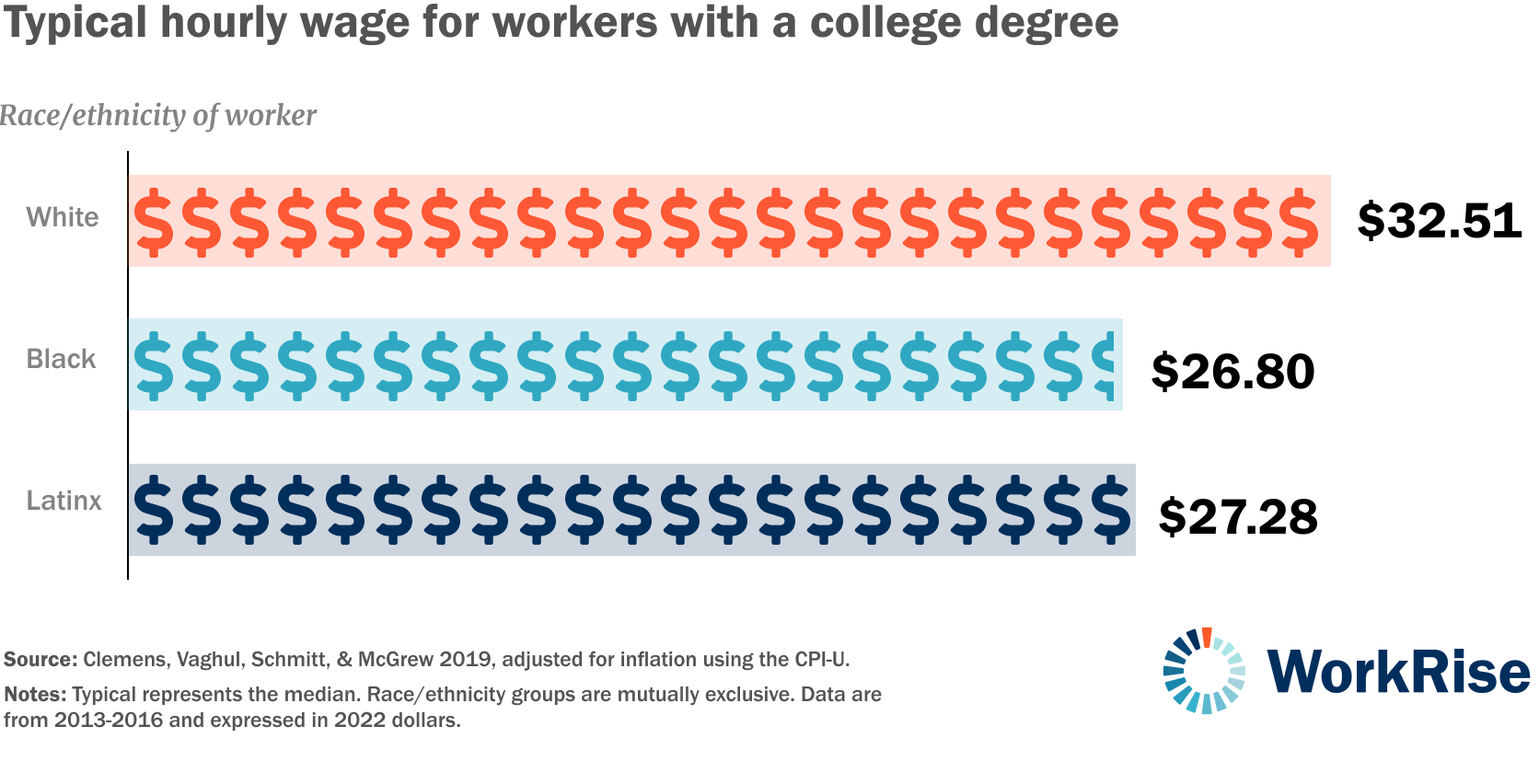

Among all working age adults, however, this subset of degree seekers saw racially disparate wages. Black workers with some college experience but no degree had a median hourly wage of $17.80 (in 2022 dollars), compared to Latinx workers at $18.58 and white workers at $21.06 with the same educational attainment. Even with a college degree, Black workers tend to make less than equally educated white workers, with median hourly wages of $26.80 and $32.51, respectively. (Clemens, Vaghul, Schmitt, & McGrew 2019)

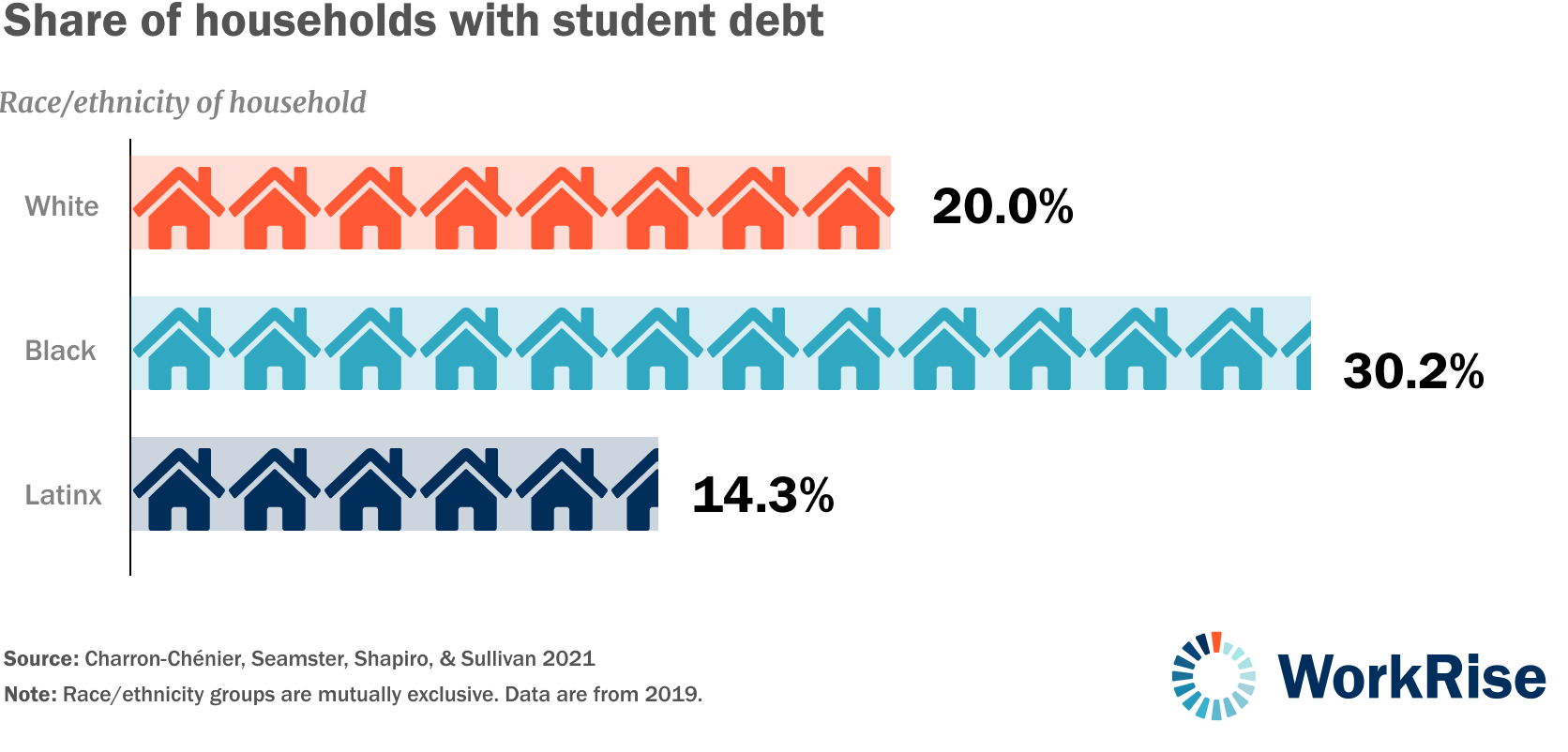

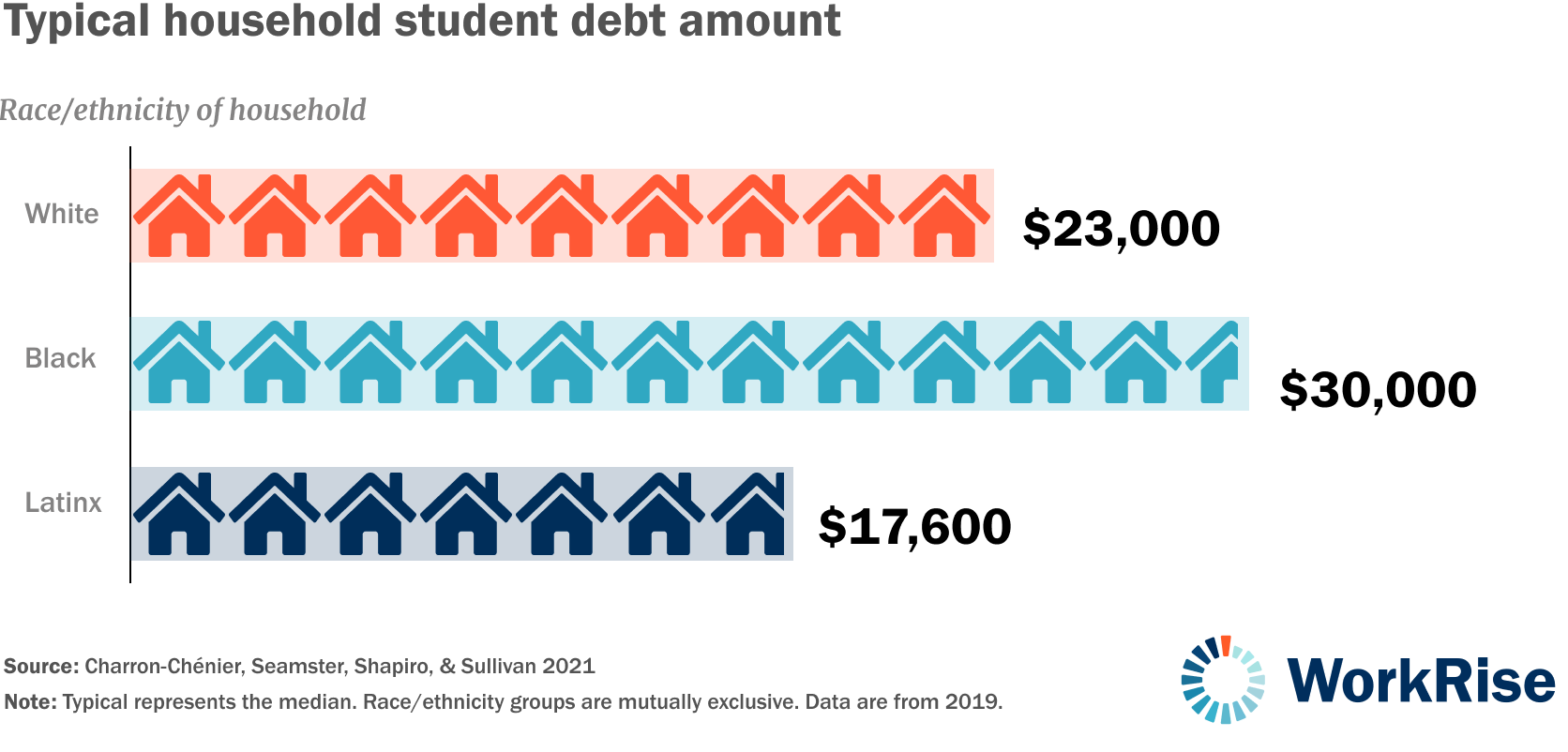

Black households are disproportionately burdened by student debt. Compared to their white and Latinx peers, Black households are more likely to hold student debt and are likely to hold more of it. As a result of income and wealth disparities, Black college graduates default on their loan debt at a rate five times higher than their white counterparts, even exceeding the default rate of white college dropouts. Despite higher educational attainment over time, median earnings have declined for most young individuals, particularly Black college graduates. The ramifications are stark: two decades after completing their education, a typical white borrower reduces their debt by 94 percent, while a typical Black borrower still carries 95 percent of their debt, and Latinx borrowers' debt remains largely unchanged (Charron-Chénier, Seamster, Shapiro, & Sullivan 2021).

The challenges of building wealth also extend to Latinx borrowers, owing to repayment struggles, diminished educational returns, escalating debt balances, and systemic racial barriers, even when considering class differences among students. This perpetuates a cycle of intergenerational wealth inequality, as these families continue to grapple with debt while facing the prospect of similarly constrained opportunities for their children's education.

Targeted approaches are needed to support the financial well-being of low-wage workers

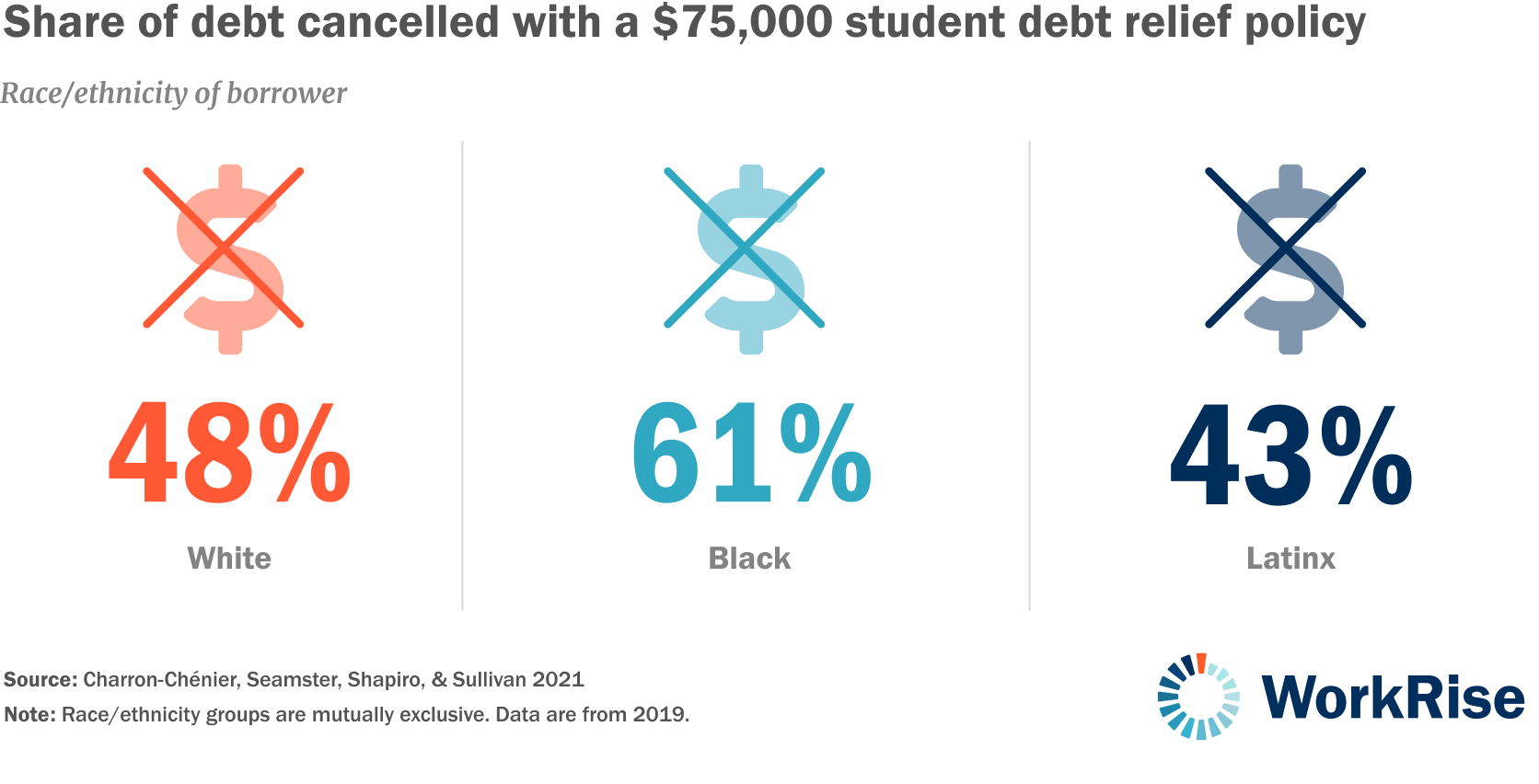

The intersection of race and student debt exacerbates racial inequalities in wealth and education. To address these long-standing disparities, federal policymakers should consider targeted debt relief. One study proposes policy levers involving cancellation amount and income eligibility caps, recommending debt relief of $50,000–$75,000 for households with an income less than $100,000. At $75,000 relief, 51 percent of all reported student debt would be canceled: 61 percent for Black, 48 percent for white, and 43 percent for Latinx borrowers (Charron-Chénier, Seamster, Shapiro, & Sullivan 2021). While the method minimally impacts the racial wealth gap, it transforms broader racial and economic inequalities, narrowing disparities for vulnerable groups, particularly Black and Latinx households.

Another set of recommendations encompass diverse policy mechanisms to alleviate the burdens of student debt. These encompass consumer-driven oversight of the loan industry, K-12 financial literacy education, transparency in loan terms, and replacing the current system with income-based repayment. These strategies align with recommendations that the Department of Education should involve vulnerable debt holders in the process of redesigning repayment systems, and consider auto-enrollment in forgiveness programs and affordable payment plans that could alleviate payment burdens for those at risk of defaulting.

Employers could offer repayment assistance for those below the poverty level. This could include dedicating resources to provide instructional aid in navigating the loan system and direct payments made by employers or unions to support low-wage employees. Under the Consolidated Appropriations Act of 2021, employers can make tax-free contributions up to $5,250 toward each employee’s loan repayment or other education expenses. An extension of this policy past 2025 could encourage more employers to participate.

To lighten the debt burdens of new borrowers or education seekers, local policymakers, practitioners, and employers could explore options to provide reduced- or no-cost community college to those for whom financial burdens prevent them from pursuing a degree. Reforming wage garnishment policy and offering tax breaks for low-income individuals making payments are other potential approaches for policymakers.

These comprehensive strategies aim to ease the intricate impact of student debt across various demographic groups, offering potential relief and improved financial outcomes. These proposals collectively aim to mitigate the complexities of the impact of student debt on vulnerable groups.

Conclusion

The impact of student loan debt on low-wage workers is profound and multifaceted. It exacerbates existing disparities in wealth and education, disproportionately affecting Black and Latinx workers. While education has long been seen as a pathway to economic mobility and racial equality, the rising cost of education, coupled with the enduring burden of student debt, has created significant obstacles for many low-income individuals.

Debt forgiveness emerges as a potential solution to alleviate the burden of student loan debt, especially for Black borrowers who carry higher debt loads. It represents a step toward racial justice by addressing the disparities in educational financing. However, it's crucial to recognize that debt forgiveness alone cannot fully eliminate racial wealth inequality. It serves as a remedial measure and harm reduction strategy but should be part of a broader policy package to comprehensively tackle racial equity concerns.

These solutions are also key to providing low-wage workers with a means of achieving economic mobility that extends beyond higher wages. The burden of student loan debt lasts for a large portion of many borrowers’ working-age lifetime and affects their financial health. It also limits their ability to invest in opportunities that could improve prospects for themselves and their children.