The Black-white wealth gap is wide. In addition to having less wealth than white families, Black families are likely to have fewer liquid assets in their wealth portfolios. The need for liquid assets can be heightened amid periods of macroeconomic stress: the combination of worse labor market outcomes for Black workers, rooted in racial discrimination, and the tighter financial conditions that often characterize a recession can make families with fewer liquid assets especially vulnerable.

Measures taken by the federal government to alleviate the financial hardship in the most recent recession led to inflationary pressures on the economy. In the event of a future recession, the federal government may want to curb its response to limit the potential for faster inflation. Instead of a universal or broad set of policy responses amid a recession, more targeted public policies should be pursued to ensure that the most vulnerable families, those facing both the tightest liquidity constraints and the highest prospects of job loss, are targeted.

Liquid assets help families stay afloat when faced with unexpected expenses or financial turmoil

Wealth is important because it provides greater flexibility and security for families than employment alone. It can also be used to invest in other opportunities that further increase wealth and support the well-being of future generations. Wealth can also be used to insulate a family from catastrophic events.

Not all wealth is the same. Liquid wealth refers to those assets that can be turned into cash quickly. It includes transaction accounts such as checking or savings accounts, cash, and directly held stocks, bonds, and mutual funds. In contrast, less liquid wealth, such as a retirement accounts or housing equity, takes more time and may be more difficult to turn into cash.

Black families have fewer liquid assets

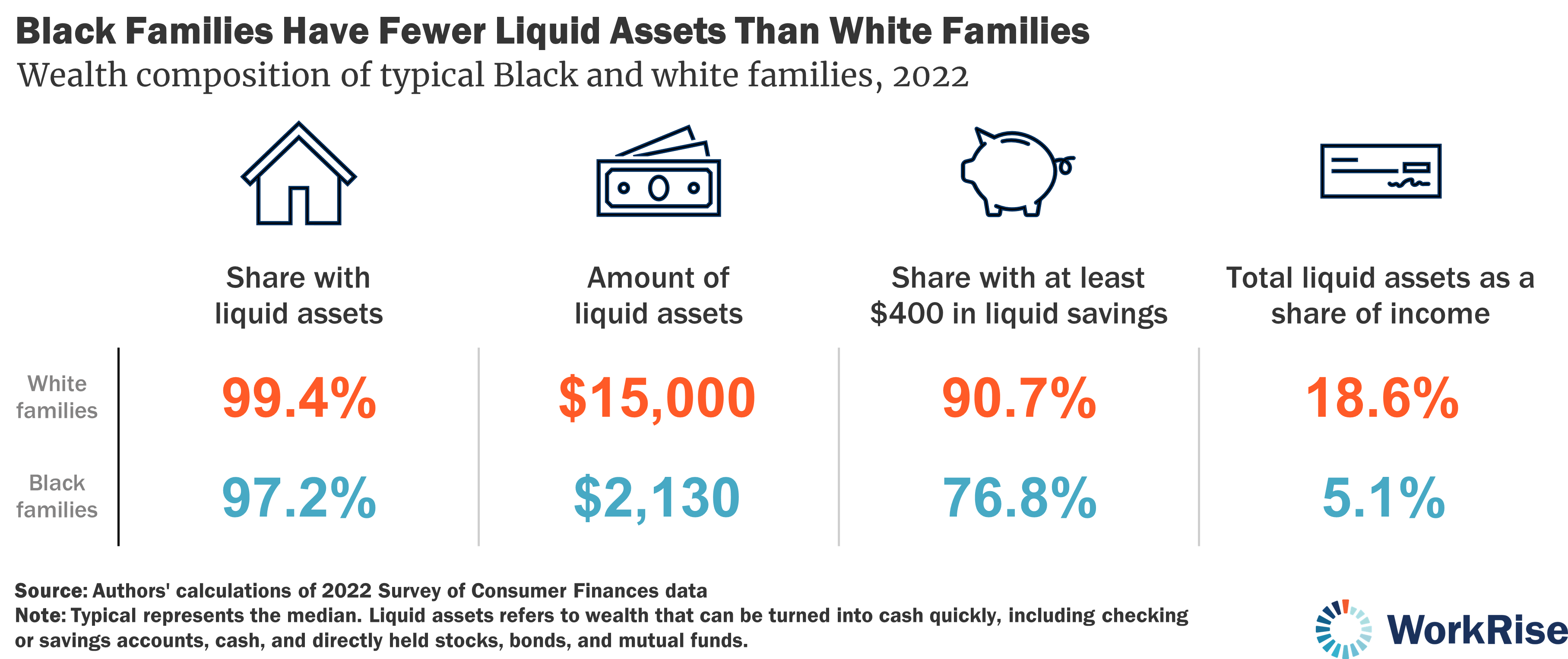

Nearly all families, whether Black or white, hold some form of liquid assets. However, a typical (i.e., median) white family owns approximately seven times the amount of liquid assets compared to a typical Black family ($15,000 versus $2,130, respectively).

Liquid wealth is critical for a family’s ability to respond to an unexpected expense or in the event of income loss. In 2022, roughly 90 percent of white families had enough liquid savings to cover a modest expense (defined as $400 in the research), while 76.8 percent of Black families were similarly situated. The gap in liquid assets is also evident by the total value of a family’s liquid assets as a share of its income, which is more than three times greater for a typical white family than a Black family (18.6 percent and 5.1 percent, respectively).

Black workers are more likely to experience unemployment during their lifetime, which reduces or eliminates income

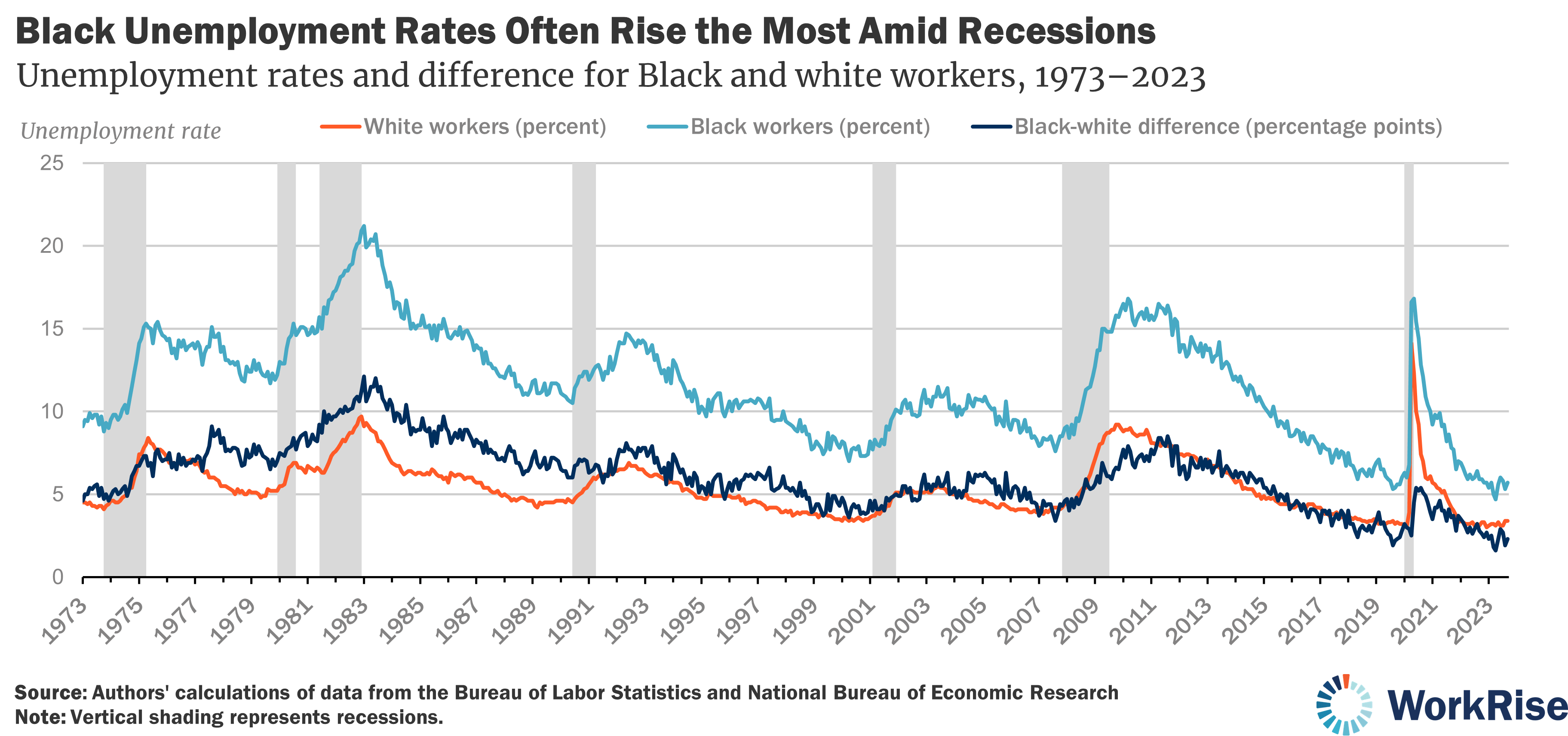

Black families’ relatively greater lack of liquid assets to cover a modest expense or replace a household’s income is amplified by unemployment. Black workers have systematically higher unemployment rates than white workers, and the rate of unemployment rises faster for Black workers amid recessions.

While the unemployment rate rises for both Black and white workers during a recession, the faster increase in the unemployment rate among Black workers, a situation that continued with the pandemic-era recession, suggests that the likelihood of income loss during a recession is likely to be greater for Black workers as well.

These financial and labor market characteristics indicate that Black families are systematically more vulnerable than white families both because they have fewer liquid assets and because they are more likely to face unemployment. A macroeconomic shock such as a recession exposes vulnerability for all families but disproportionately impacts Black families. Moreover, while interest rates may be lower during a recession, credit standards typically tighten, further complicating the ability of families to access cash from less liquid assets like their homes.

Policy considerations must remain focused on supporting the most vulnerable families

Amid faster inflation in the most recent recovery, the Federal Reserve tightened monetary policy by boosting interest rates. Higher interest rates then sparked concerns about a future recession, which were multiplied by the closure of Silicon Valley Bank and other depository institutions. Recent news indicates that key forecasters including the Federal Reserve do not believe that a recession is imminent. However, the prices of US Treasury securities suggest that bond traders still believe that a recession is coming.

The risk of a recession is uncertain. Key forecasters have pivoted from earlier pessimism, but the US Treasury pricing suggests that bond traders remain wary. In response to the pandemic recession, the federal government responded forcefully with economic impact payments, expanded unemployment insurance, and instituted institutional forbearance for many student and home loans, among other key steps. These helped to dampen the impact of holding few liquid assets at a time of soaring unemployment.

However, the aforementioned policies, combined with tighter supply chains, likely contributed to the higher inflation still being fought today. Although evidence suggests that these impacts on inflation are waning, increasingly replaced by pressures from a tight labor market, there may be less appetite for a similarly sized federal response in the next recession. And this could disproportionately undermine the well-being of Black families.

The experience of the COVID recession was a reminder of the complexities behind inflation. However, there are still several steps that policymakers could take to protect vulnerable families during the next recession while working to limit any inflationary impact. While extending unemployment insurance to improve coverage for Black families is a structural deficiency in need of fixing, benefits by the federal government for unemployed workers should be designed to more closely match the proportion of income that they typically spend.

Black workers spend a larger share of income compared to the average white workers. Tailoring this countercyclical policy to spending patterns should still ensure that Black workers can purchase necessities amid higher unemployment. Federal support of consumers will boost demand and pressure inflation. But its impact on total consumption over time should be smaller because federal support is better targeted, both by focusing on only typical spending and eliminating the ability to save federal assistance and by disproportionately reducing assistance for those who spend less of their income. In addition, maintaining a focus on minimizing potential supply chain disruptions today can help reduce cost pressures during future recessions.

Conclusion

Racial differences in liquid assets owned can matter during times of macroeconomic stress. Black families have less of their wealth invested in liquid assets and face a greater likelihood of job loss in periods of recessions. This may increase their need for public assistance during an economic downturn. It is important that the public safety net catches everyone, but better targeting on likely need is one way to implement key learnings from the pandemic recession. Doing so could help limit the potential for faster inflation while ensuring that more vulnerable households are supported in a recession.